Managing finances as a couple can be challenging, especially when juggling joint expenses, savings goals, and differing spending habits. Communication and organization are key to maintaining a healthy financial relationship, and this is where free budgeting apps for couples come into play. These apps offer features that make it easier for couples to track spending, save together, and stay on the same page regarding their financial goals—all without spending a dime. This article explores the benefits of using free budgeting app for couples and highlights some of the top options available.

Why Couples Need Budgeting Apps

When two people come together to manage finances, transparency and accountability become crucial. Whether you have joint accounts or keep separate ones, budgeting apps help ensure both partners are aware of the household finances and their individual spending patterns. These apps allow couples to set shared financial goals, manage bills, and track expenses in real time, fostering open communication and reducing the potential for conflicts over money.

Additionally, budgeting apps provide insight into where your money is going, helping you identify areas where you can cut back or reallocate funds. They simplify the process of managing finances by syncing transactions automatically from multiple accounts, offering reminders for upcoming bills, and providing visual reports to give a clear picture of your financial health.

Key Features of Free Budgeting Apps for Couples

- Shared Access and Synchronization: A key feature of free budgeting apps for couples is the ability to link multiple accounts and allow both partners to access and track spending in one place. Whether you’re managing joint accounts or separate ones, these apps synchronize all transactions in real time so both partners can stay up-to-date on the household budget.

- Expense Tracking: Budgeting apps automatically categorize expenses, helping you and your partner see where your money is going. Whether it’s groceries, utilities, or entertainment, you can easily track individual and shared spending habits.

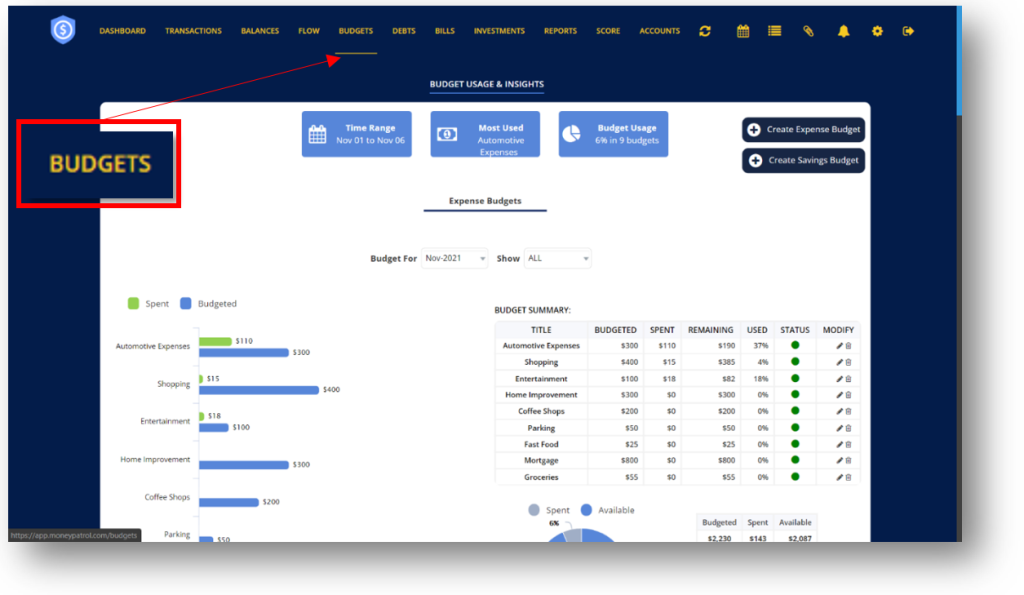

- Budget Creation and Customization: Couples can create a customized budget based on their combined income and financial goals. You can set limits for various spending categories, adjust them as needed, and track how well you’re sticking to the plan.

- Financial Goal Setting: Whether you’re saving for a vacation, buying a home, or building an emergency fund, budgeting apps allow couples to set joint financial goals. You can allocate money toward these goals and track your progress together.

- Bill Tracking and Reminders: The best free budgeting apps send reminders for upcoming bills, helping you avoid late fees and missed payments. This feature ensures that both partners are aware of financial responsibilities and can plan accordingly.

- Visual Reports and Insights: Couples benefit from the app’s visual representations of their spending habits, such as pie charts and graphs. These insights make it easier to discuss financial progress, identify trends, and make informed decisions together.

Final Thoughts

Free budgeting apps for couples provide a simple and effective way to manage shared finances, reduce money-related stress, and work toward financial goals together. By offering features like shared access, real-time synchronization, and detailed insights into spending habits, these apps promote transparency and accountability. Whether you prefer managing joint accounts or keeping things separate, there’s a free budgeting app that can help you and your partner stay on the same page financially. Using one of these apps can be a significant step toward achieving your shared financial goals while fostering open communication and trust in your relationship.