Planning for retirement involves careful consideration of various factors, including pension contribution limits, which play a significant role in shaping your financial future. In Ireland, understanding how these limits affect your retirement savings strategy is essential for effective financial planning. This article explores the impact of pension contribution limits on your retirement and offers insights into how you can navigate them to achieve your retirement goals with an Executive Pension.

Understanding Pension Contribution Limits

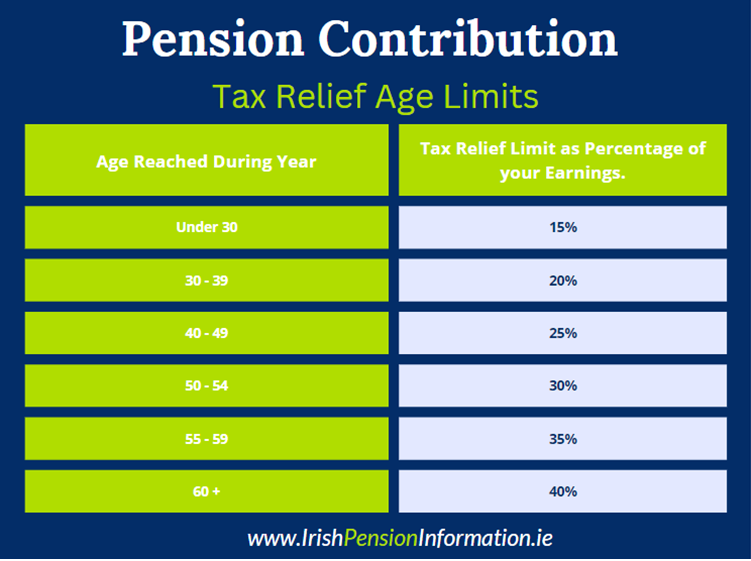

Pension contribution limits refer to the maximum amount of money that individuals can contribute to their pension funds within a specified period while still benefiting from tax relief. In Ireland, these limits are set by Revenue Ireland and vary based on factors such as age, income level, and type of pension scheme.

The Impact on Retirement Savings

Pension contribution limits directly impact the amount of money individuals can save for retirement tax-efficiently. Exceeding these limits will result in the loss of tax relief benefits, making it crucial for individuals to stay within the prescribed limits when making contributions to their pension funds.

Balancing Tax Efficiency and Retirement Goals

While maximising pension contributions offers significant tax benefits, individuals must strike a balance between tax efficiency and their retirement goals. Contributing the maximum allowable amount to their pension funds can help individuals optimise tax relief and build a substantial retirement nest egg. However, exceeding contribution limits may not always align with retirement objectives.

Tailoring Your Retirement Strategy

To navigate pension contribution limits effectively, individuals should tailor their retirement strategy to their unique circumstances and goals. This involves assessing current financial resources, estimating future retirement needs, and adjusting contribution levels accordingly. By working with financial advisors and leveraging available tax incentives, individuals can create a personalised retirement plan that maximizes savings while staying within contribution limits.

Exploring Alternative Retirement Savings Vehicles

In cases where pension contribution limits pose restrictions, individuals can explore alternative retirement savings vehicles to supplement their pension funds. Options such as individual savings accounts, investment portfolios, and property investments can provide additional avenues for retirement savings, allowing individuals to diversify their savings and mitigate risks associated with contribution limits.

Conclusion

Planning for retirement requires careful consideration of pension contribution limits and their impact on your financial future. By understanding these limits and adopting a strategic approach to retirement planning, individuals can optimise their savings while ensuring tax efficiency and alignment with retirement goals. By staying informed, seeking professional advice, and exploring alternative savings options, individuals can navigate pension contribution limits effectively and build a secure financial future for their retirement years.